The Customs, Excise, & Trade Operations of the Guyana Revenue Authority (GRA) has suspended the requirement for Government, Budget Agencies, Semi-Autonomous Agencies, Subvention Agencies and Diplomatic Missions/Agencies to complete and submit a Form C32A (DECLARATION OF PARTICULARS RELATING TO CUSTOMS…

The under mentioned applications have been received for the grant of certificates for the issue of Excise Licences under the provision of Section 10 (4) of the Intoxicating Liquor Licensing Act, Chapter 82:21. NEW LICENCES NO. TYPE OF LICENCE…

The under mentioned applications have been received for the grant of certificates for the issue of Excise Licences under the provision of Section 10 (4) of the Intoxicating Liquor Licensing Act, Chapter 82:21. NEW LICENCES NO. TYPE OF LICENCE…

The under mentioned applications have been received for the grant of certificates for the issue of Excise Licences under the provision of Section 10 (4) of the Intoxicating Liquor Licensing Act, Chapter 82:21. APPLICATION TO TRANSFER FROM PERSON TO…

Temporary closure (New Amsterdam Office) On Monday, March 1, 2021, the Guyana Revenue Authority (GRA) Integrated Regional Tax Office, New Amsterdam, will be relocating to Lot 8 Ferry Street and Esplanade Road. As a consequence of the relocation, the current…

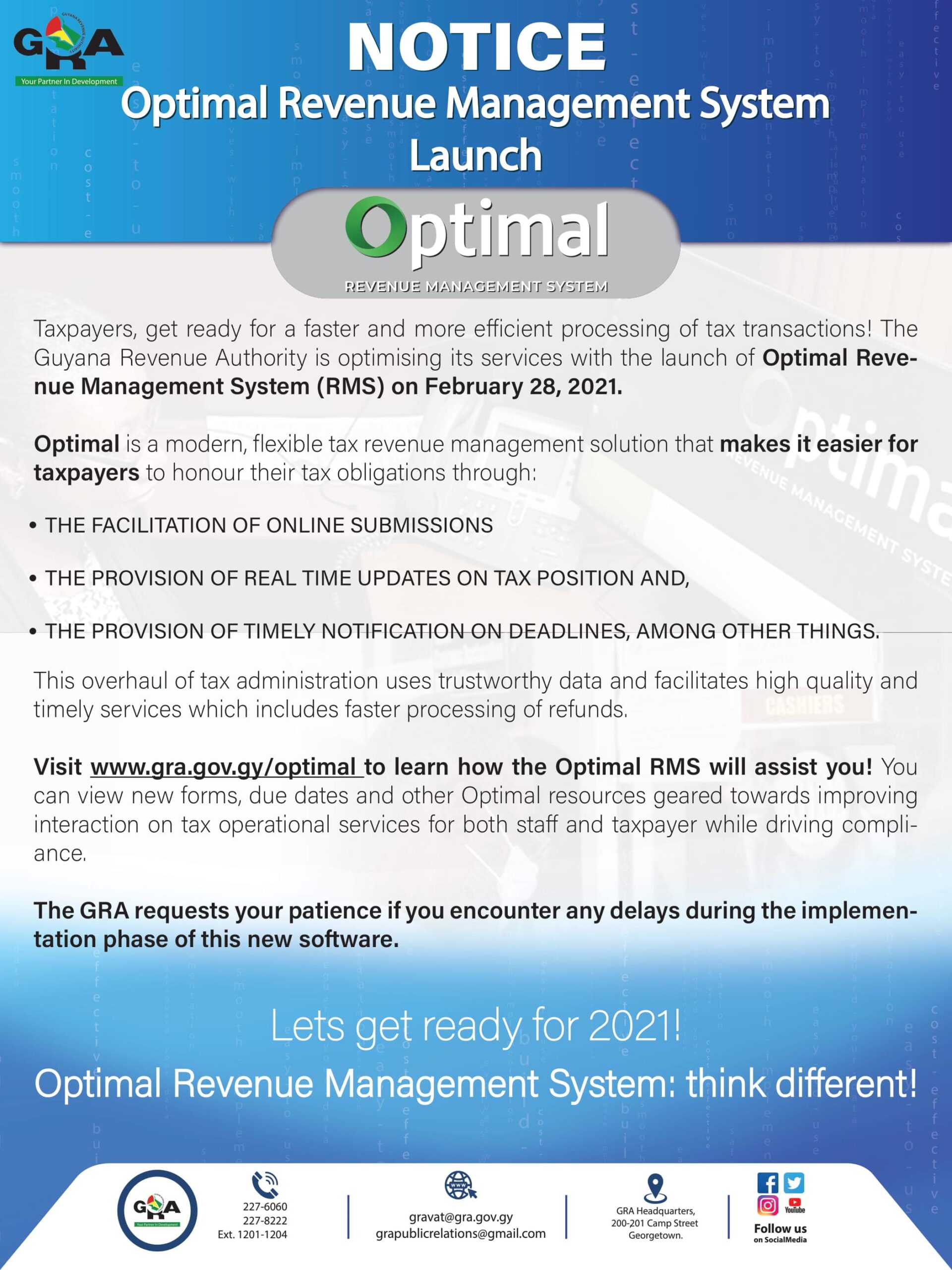

For more on Optimal visit www.gra.gov.gy/optimal to learn how the Optimal RMS will assist you! You can view new forms, due dates and other Optimal resources geared towards improving interaction on tax operational services for both staff and taxpayer while…

SALE OF WANT OF ENTRY CONTAINERISED CARGO, EXCAVATOR AND PERSONAL EFFECT CONSIGNMENTS (STORED IN THREE (3) CONTAINERS) BY SEALED BIDS The Guyana Revenue Authority (GRA) is inviting sealed bids for the purchase of Want of Entry Containerised Cargo on a…

The Guyana Revenue Authority wishes to remind the general public that an item shall be classified as Want of Entry cargo if the importer or any such person fails to have their consignment entered, within fourteen days, (exclusive of public…

The Guyana Revenue Authority (GRA) wishes to remind taxpayers that vehicles registered in the ‘G’ series must abide by the following conditions: Seats behind the driver are to be completely removed Windows, other than that of the driver and passenger,…

The Guyana Revenue Authority (GRA) would like to remind the general public that anyone caught attempting to smuggle uncustomed goods will be subjected to the necessary seizures and penalties in accordance with the laws of Guyana. In accordance with Section…