Georgetown, GRA, Thursday, May 28 2020: The Guyana Revenue Authority (GRA) mourns the loss of another reputable career individual who made an indelible mark in Guyana’s tax administration, Mr. Clarence Chue. He passed away on May 27, 2020 at the…

Georgetown, GRA, Wednesday, May 27, 2020: Management and staff of the Guyana Revenue Authority (GRA) are deeply saddened by the news of the passing of former Commissioner-General Mr. Khurshid Sattaur on Tuesday, May 26, 2020. The Revenue Authority uses this…

Georgetown, GRA, April 21, 2020: The Commissioner-General wishes to refute in no uncertain terms a “fake press release” being bandied about on the worldwide web, and purportedly emanating from the Guyana Revenue Authority (GRA) advising the general public that tax collection…

Georgetown, GRA, April 7, 2020 : In the ongoing national effort to support businesses and individuals who have been socially and economically disadvantaged by the threat of the corona virus (COVID-19) pandemic, the Government of Guyana today approved a number…

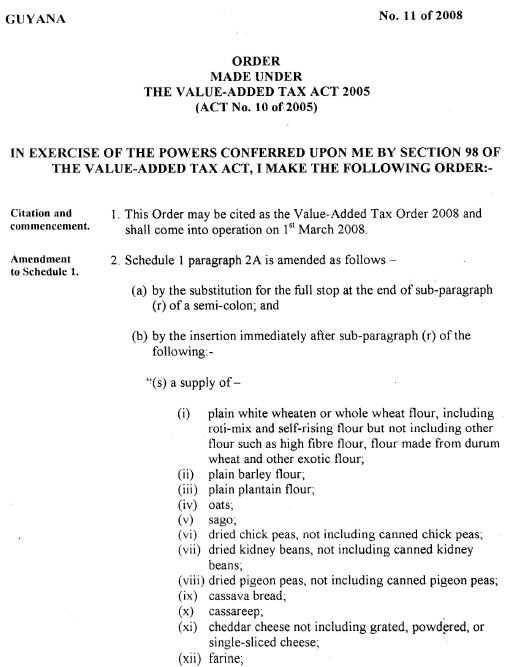

The Guyana Revenue Authority (GRA) hereby advises that in accordance with the amendments to the Value-Added Tax (VAT) Act, the following which are linked to computers, computer parts, components and printers must be treated as exempt from VAT: COMPUTER CATEGORIES: Supercomputer,…

The Guyana Revenue Authority (GRA) is mandated under the Foreign Accounts Tax Compliance Act (FATCA) to report accounts of United States (US) citizens to the US Internal Revenue Service (US-IRS) on an annual basis. In fulfilling this obligation, Financial Institutions…

Value-Added Tax is EXEMPT from complete housing units costing up to $6.5M. These housing units must be built by, or on behalf of, the Central Housing and Planning Authority (CH&PA) or any other approved entity. This measure is in accordance with Section…

Adopted by the Shipping Association of Guyana DESCRIPTION OF VARIOUS CARGO Identification of Cargo & Abbreviations DESCRIPTION ABBREVIATION CRATE (CRT) CASE (CS) PALETTE (PLT) SKID (SKD) PACKAGE (PKG) BOX, CARTON & BIN BOX (48*24*28) (BX | CTN) PLASTIC CONTAINER R)…