Effective Monday, June 1, 2020 the general public is encouraged to utilise the Guyana Post Office Corporation (Robb Street entrance) to make payments for the following services: All Internal Revenue Taxes Customs Duties and Taxes Motor Vehicle Licences Value Added…

The general public is hereby notified that the exemption of Value Added Tax (VAT) on electricity as a COVID-19 relief measure will be implemented by the Guyana Power & Light Inc. as follows: Pre-paid consumers: There will be an immediate…

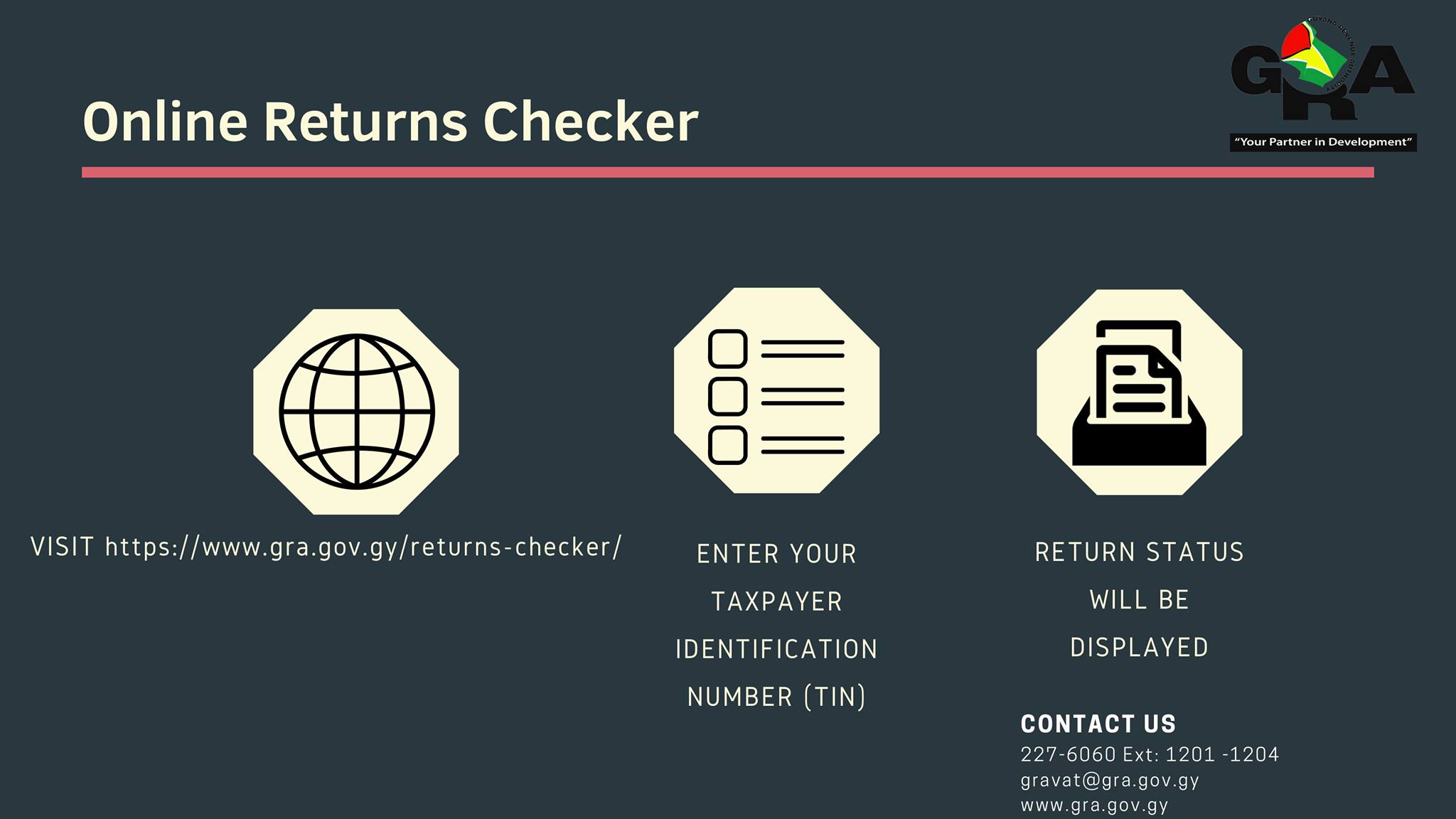

The Guyana Revenue Authority (GRA) wishes to advise businesses and companies that Value Added Tax (VAT) & Pay As You Earn (PAYE) Returns can be submitted electronically using the eservices link https://eservices.gra.gov.gy VAT taxes and Returns are due on March…

Resulting from the COVID-19 pandemic, certain measures were implemented by the Guyana Revenue Authority, including the suspension of the sale of licences. Now that the April 30 deadline has elapsed, the general public is hereby notified that the Authority has…

The Guyana Revenue Authority (GRA) has introduced the pre-payment functionality in ASYCUDA World for all Export Declarations in an effort to minimize and safeguard against the current spread of COVID-19. With immediate effect, the GRA is urging all frequent Exporters…

As part of efforts to minimise the risk of spreading the novel COVID-19 (corona virus), the Guyana Revenue Authority (GRA) is accepting applications for the Taxpayer Identification Number (TIN) Certificates online. First-time applicants are encouraged to email scanned copies of…

The Guyana Revenue Authority (GRA) wishes to notify the general public that as of April 1, 2020, the following services will be offered at the Mabaruma Integrated Regional Tax Office: Payment for all Tax types Issuance of Motor Vehicle Licences Issuance…